Homeowners Insurance in and around La Fayette

If walls could talk, La Fayette, they would tell you to get State Farm's homeowners insurance.

Apply for homeowners insurance with State Farm

Would you like to create a personalized homeowners quote?

Home Sweet Home Starts With State Farm

When you’ve worked a long shift, there’s nothing better than coming home. Home is where you take it easy, relax and slow down. It’s where you build a life with your favorite people.

If walls could talk, La Fayette, they would tell you to get State Farm's homeowners insurance.

Apply for homeowners insurance with State Farm

Protect Your Home With Insurance From State Farm

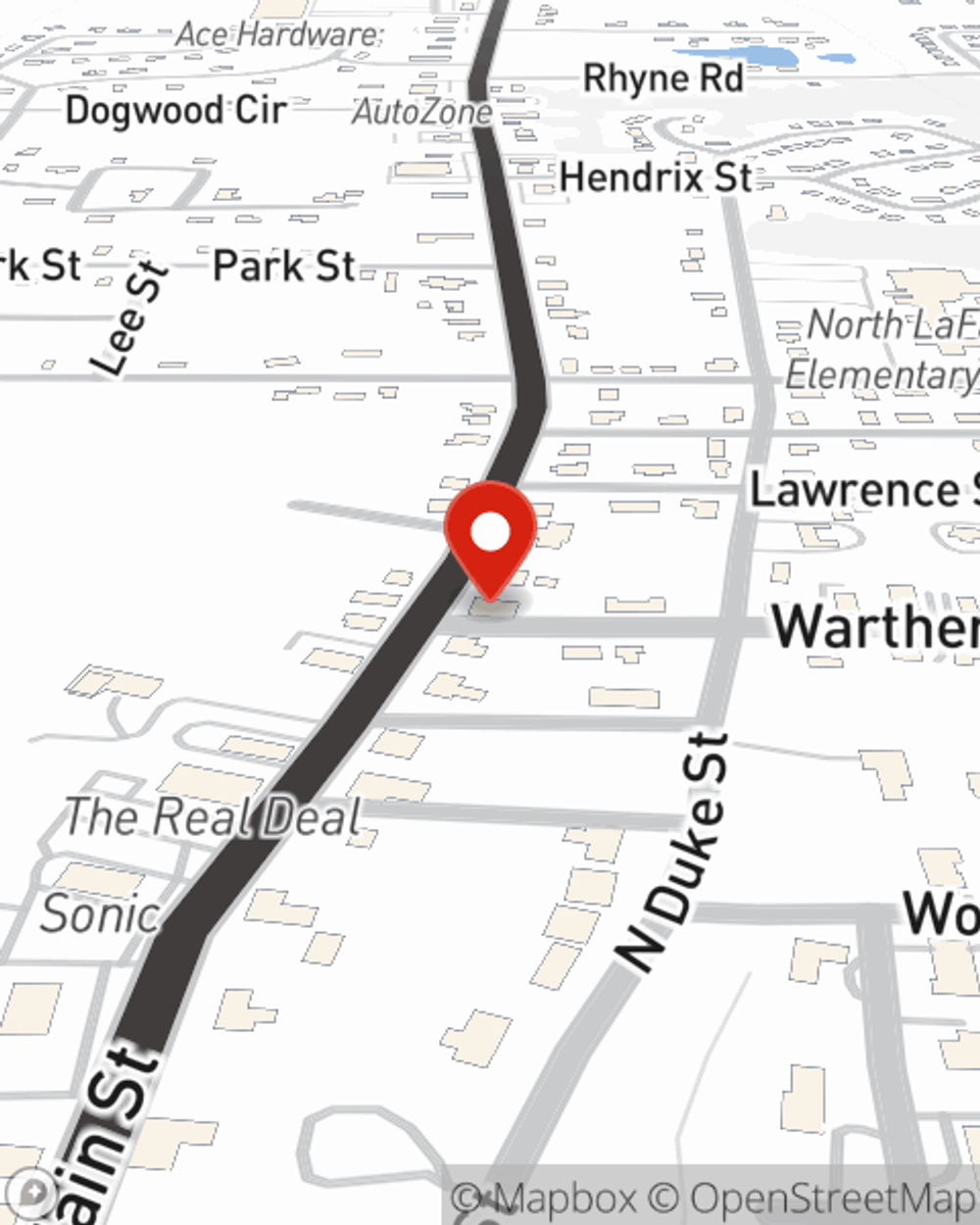

Your home is the cornerstone for the life you are building. That’s why you need State Farm homeowners insurance, just in case trouble comes knocking. Agent Sallie McGinnis can roll out the welcome mat to help set you up with a plan for your particular situation. You’ll feel right at home with Agent Sallie McGinnis, with a no-nonsense experience to get reliable coverage for your homeowner insurance needs. Customizable care and service like this is what sets State Farm apart from the rest. Home can be a sweet place to live with State Farm homeowners insurance.

Don’t let concerns about your home keep you up at night! Visit State Farm Agent Sallie McGinnis today and find out the advantages of State Farm homeowners insurance.

Have More Questions About Homeowners Insurance?

Call Sallie at (706) 638-3555 or visit our FAQ page.

Protect your place from electrical fires

State Farm and Ting* can help you prevent electrical fires before they happen - for free.

Ting program only available to eligible State Farm Non-Tenant Homeowner policyholders

Explore Ting*The State Farm Ting program is currently unavailable in AK, DE, NC, SD and WY

Simple Insights®

Sauna benefits, types and safety tips

Sauna benefits, types and safety tips

A good steam bath is invigorating. Learn the benefits of saunas and the best way to use them with these simple but important safety tips.

Severe weather safety tips

Severe weather safety tips

Severe weather and wind are common throughout the country. Read these storm safety tips to help with your emergency planning.

Sallie McGinnis

State Farm® Insurance AgentSimple Insights®

Sauna benefits, types and safety tips

Sauna benefits, types and safety tips

A good steam bath is invigorating. Learn the benefits of saunas and the best way to use them with these simple but important safety tips.

Severe weather safety tips

Severe weather safety tips

Severe weather and wind are common throughout the country. Read these storm safety tips to help with your emergency planning.